3 minutes

Born in 1980, I was one of the first Millennials, not that I knew it at the time. I was an early adopter. And now everyone in finance is finally talking about my kind, my generation. Others call me an expert in innovations within the banking and insurance industry: my job is giving advice on how to be better – digitally better, more engaging, more innovative. But this guide is truly and only subjective. I might have some of my own research and the research conducted by others in the back of my mind – occupational hazard. Nevertheless, this is supposed to be personal. And I feel entitled by one lesson I have learned in my life: the more personal you speak, the more general you end up being.

The Millennials described here equal my behavior. It’s up to you if you think some of these facts are valid to other Millennials as well.

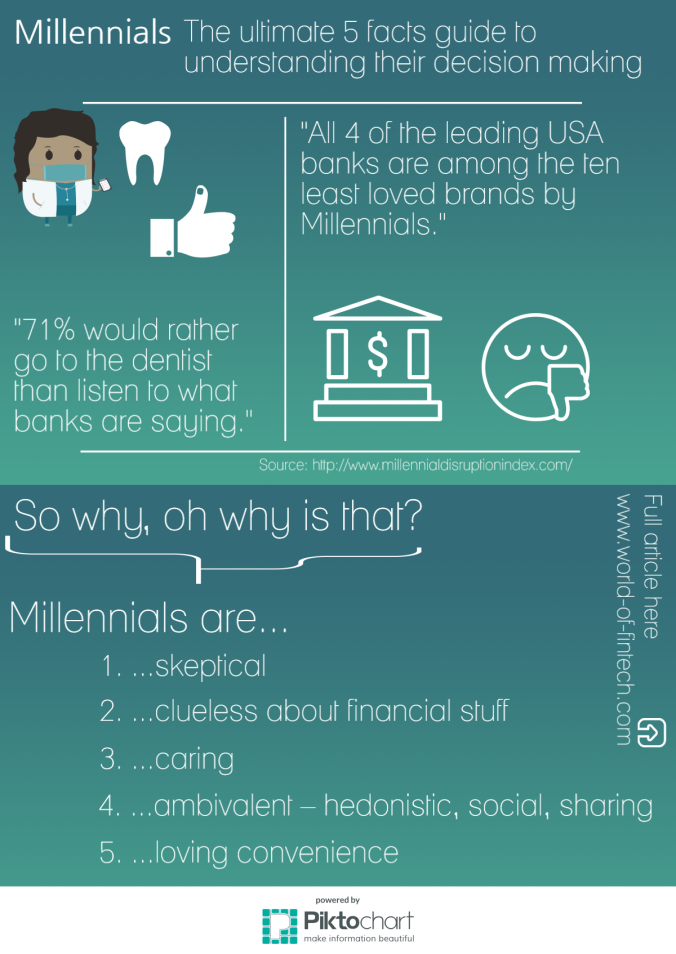

Fact 1: I am skeptical

When I want to purchase something – especially a complex or high involvement good or service – like deciding on a car or signing a retirement plan – I don’t believe the salespeople. Cause the scandals of the past plus the internet, which is a big fat and easy playground of comparison and opinion sharing, made me highly sceptical. Is the guy selling the car and the lady selling the retirement plan talking to me with my best interest in mind? Or for his or her own wallets’? It is merely logical that a lot of people would decide for the latter – so they can buy a new car or retirement plan. So I am heading towards new players communicating more transparently – having no scandals in their past.

Fact 2: I am clueless about financial stuff

Yes, stuff… cause I might not even know the right terms to use while researching for and making the financial decisions. And a lot of banks and insurances companies support it with their language which seems to be from outer space unless you were at the same university as those guys. From the galaxy of complexity, lightyears away from a language everyone can understand. And I conducted a ton of primary research over the last years assessing banks and insurers websites. I can say: I still don’t understand everything I have read there. And no, I am not stupid… Back to my peers, the Millennials: I want to know what I buy. I even feel betrayed by companies not trying hard enough to make me understand what I buy – with every possible consequence of my decision.

Fact 3: I am caring

I care about my environment, my family, my friends, my company, myself and the world as a whole. So I am continually trying to make decisions that are positively influencing these categories of caring. If I have the money, and therefore am also of high interest for banks, insurers, and fintechs trying to win me as a customer, I have the chance to buy some guilt away. And I do. Cause I care, and I want the most possible positive impact of my being, doing, making, living on those and other categories of caring.

Fact 4: I am ambivalent – hedonistic, social and a sharer

I can easily hop on a plane to have a spontaneous weekend in Barcelona just to have some great tapas and meet some new people. I don’t care about expenses, the environment, or losing my good night sleep. The next weekend I am taking strangers with me in my car driving from Bavaria to Amsterdam – even if that is more inconvenient. But I am sick of driving over a thousand kilometres in an empty car polluting the air even more than I have to. That simply doesn’t make sense to me (see Millennials are caring). I choose the job where I really like the people I work with over having a company car, and at the same time, I am not willing to sell myself under my market price. I want the party and the good night sleep. And this story can go forever. So if you address Millennials like me, it is also an excellent chance for you to position your brand. Think about which great unique ideas you can sell to these involved people. ?

Fact 5: I like convenience

…a lot. I like it even more than security – trust me! Why is PayPal successful? Cause they made online payment easy to me. Why Apple? Cause they made computers and phones easy (well, and beautiful to look at, even a little sexy). I love simplicity and convenience. If someone makes something easy and convenient, it makes my life less complicated. And that is what I need! My life is complex enough. I have no time to deal with things I don’t even really care about.

So if you want to catch me and my peers – the Millennials:

- be transparent

- communicate eye level

- make me believably feel that you care about my needs – be and act fair on every level

- catch me on the aspects I care about

- design smooth, beautiful and hassle free goods and services

FinTechs have already started the race to win the customer with technical and conceptual innovations addressing these needs and wants of Millennials…

Here are a few links if you like to read more about Millennials doing banking:

Marty Swant: Infographic: Why Millennials Are Losing Interest in Banks

Ali Donaldson: Millennials Ditch Big Banks and Go Local With Their Money

Danny Crichton: Millennials Are Destroying Banks, And It’s The Banks’ Fault

Ian Rosen: Millennials & Banks: Hate’s a strong word. They don’t care.

Douglas Hartung: Winning over millennials with a better banking experience